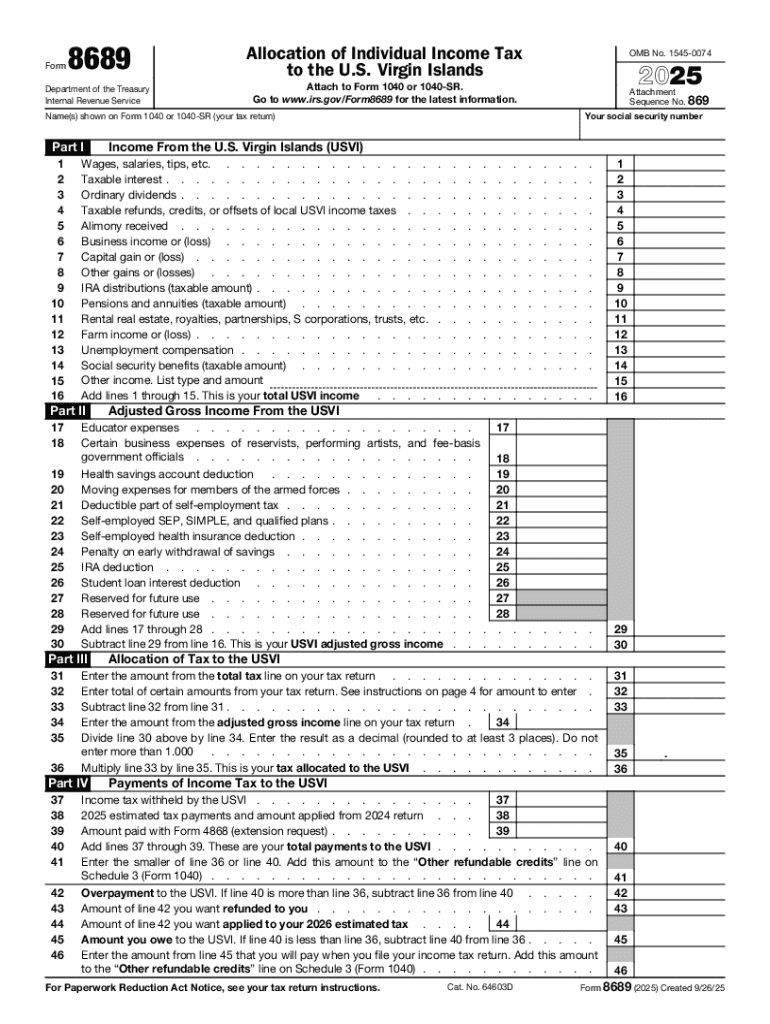

IRS 8689 2025-2026 free printable template

Instructions and Help about IRS 8689

How to edit IRS 8689

How to fill out IRS 8689

Latest updates to IRS 8689

All You Need to Know About IRS 8689

What is IRS 8689?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8689

How can I correct mistakes after filing IRS 8689?

If you need to correct mistakes on your IRS 8689 after it has been filed, the best course of action is to submit an amended form. Be sure to highlight the corrections clearly. Additionally, retain records of your original submission and any correspondence related to the amendment for your records.

How can I verify the status of my IRS 8689 submission?

To verify the status of your IRS 8689 submission, you can use the IRS's online tracking tools or contact their customer service. It's important to have your submission details handy when checking your status to ensure a smooth verification process.

What are common errors to watch for when filing IRS 8689?

Common errors when filing IRS 8689 include mismatched identification numbers and incorrect amounts reported. It's crucial to double-check all entered information and ensure that any documentation is complete to avoid potential rejections or delays in processing.

What should I do if I receive a notice regarding my IRS 8689 submission?

If you receive a notice regarding your IRS 8689 submission, read it carefully to understand the issue. Prepare any required documentation and respond promptly. If the notice pertains to corrections or additional information, follow the instructions provided to address the matter effectively.