Who Must File South Carolina tax return?

You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina. You had South Carolina income taxes withheld from your wages. You are married filing jointly, age 65 or older and your gross income is greater than federal gross income filing requirement amount plus $30,000.

Can you send certified mail to Internal Revenue Service?

If you need to file a paper tax return, consider sending it by certified mail, with a return receipt. This will be your proof of the date you mailed your tax return and when the IRS received it. You may also use certain private delivery services designated by the IRS.

What address do I send my federal income tax return to?

Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014.

What is Form 8888 total refund per computer?

Form 8888 allows a Taxpayer to split one refund in up to three accounts or Savings Bonds. If you didn't file the Form 8888 with your return, the 0.00 value is correct.

Are the Virgin Islands tax free?

US Virgin Islands Withholding Forms US Virgin Islands does not use a state withholding form because there is no personal income tax in US Virgin Islands.

What is form 8887 used for?

States should begin programming IRS Form 8887 (attached) into their benefits systems to comply with requirements of the health insurance tax credit. IRS Form 8887 will be used as documentation of TAA/TRA eligibility by individuals who claim the tax credit.

Interest earned on I bonds is exempt from state and local taxation, but owners can also defer federal income tax on the accrued interest for up to 30 years.

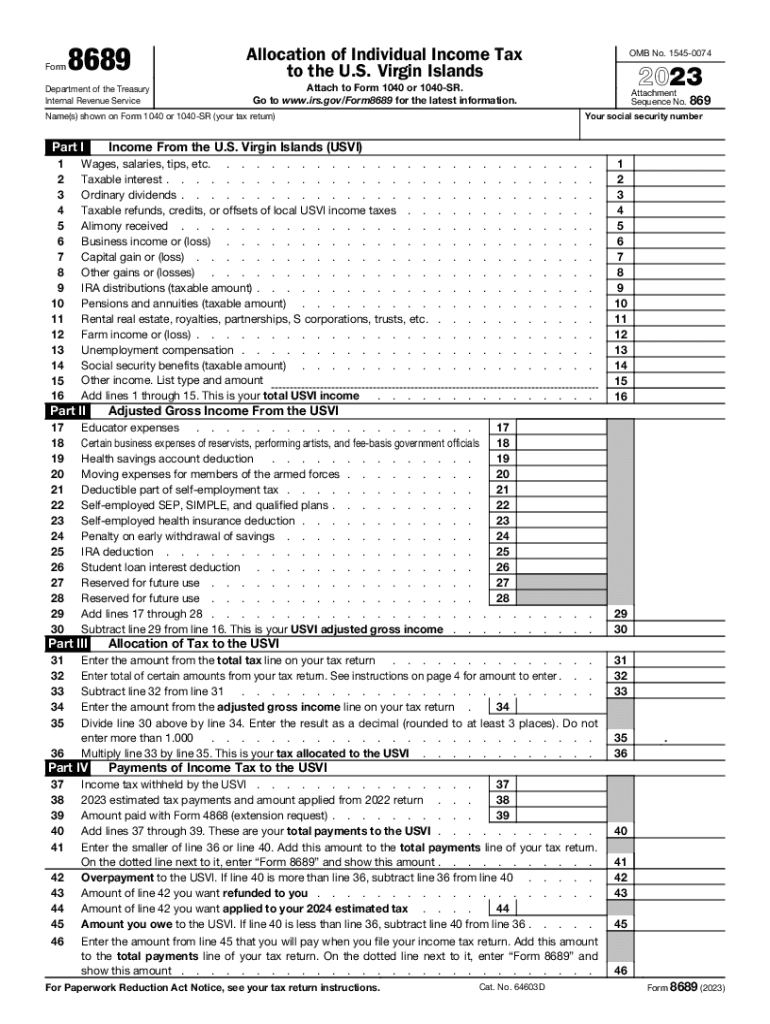

A U.S. citizen or resident alien (other than a bona fide resident of the U.S. Virgin Islands (USVI)) with income from sources in the USVI or income effectively connected with the conduct of a trade or business in the USVI uses this form to figure the amount of U.S. tax allocable to the USVI.

Can I submit form 8888 online?

File Form 8888 electronically to get your refund faster.

Do residents of USVI pay federal income tax?

Generally, instead of filing returns and paying taxes to the IRS, residents of the USVI, and corporations[3] formed in the USVI, file returns and pay income taxes directly the Virgin Islands Bureau of Internal Revenue[13].

Where do I file Form 8689?

If you are not enclosing a check or money order, file your original tax return (including Form 8689) with the Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0215 USA.

Do I mail my federal and state taxes to the same address?

No, if you are mailing your income tax returns, they do not go to the same address. To find the mailing address, for your state income tax return, click on contact the Department of Revenue and find your state.

What does form 8888 total refund per computer mean?

Form 8888 allows a Taxpayer to split one refund in up to three accounts or Savings Bonds. If you didn't file the Form 8888 with your return, the 0.00 value is correct.

How do I file taxes in the US Virgin Islands?

If you are a bona fide resident of the US Virgin Islands, you will need to file a US Virgin Island tax return with the Virgin Islands Bureau of Internal Revenue instead of the IRS. The Virgin Islands Bureau of Internal Revenue and the IRS are not the same entity although the same tax rates and laws apply.

A U.S. citizen or resident alien (other than a bona fide resident of the U.S. Virgin Islands (USVI)) with income from sources in the USVI or income effectively connected with the conduct of a trade or business in the USVI uses this form to figure the amount of U.S. tax allocable to the USVI.

Where do I file my USVI tax return?

File a signed copy of your tax return (with all attachments, forms, and schedules, including Form 8689) with the Virgin Islands Bureau of Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, VI 00802. They will accept a signed copy of your U.S. return and process it as an original return.

Use Form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or credit union) in the United States. This form can also be used to buy up to $5,000 in paper series I savings bonds with your refund.

Where do I mail Form 8689?

Where to file. You must file identical tax returns with the United States and the USVI. If you are not enclosing a check or money order, file your original tax return (including Form 8689) with the Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0215 USA.

How do I submit a form 8888?

Instead, request direct deposit on your tax return. All Form 8888 deposits must be to accounts in your name, your spouse's name, or a joint account. You can't file Form 8888 if you file Form 8379 (Injured Spouse Allocation) or with an amended tax return. File Form 8888 electronically to get your refund faster.

Do I need to file form 8888?

Form 8888 should be used for the direct deposit of your refund into two or more accounts, including the purchase of U.S. savings bonds. You should also be aware that your deposits may be rejected by your financial institution if: the account is in someone else's name or.